Hempstead Town Supervisor Don Clavin and Receiver of Taxes Jeanine Driscoll today delivered a bit of good news for the taxpayers of America’s largest township and across Nassau County. Clavin and Driscoll, who joined with members of the Hempstead Town Board on January 4th to send a letter to the Governor to call for an extension to the first-half general tax deadline, announced that the Governor has granted their request. Today, the Governor announced that the first-half general tax deadline for Nassau taxpayers, originally set for February 10th, has now been extended to March 12th.

“We are grateful that the Governor has granted our request to extend the first-half general tax deadline to March,” Clavin said. “We stood here on January 4th, just days after the calendar turned to the year 2021, and called for this important extension because we all knew that the pandemic would still be taking a major economic and health toll on our residents. Gaining some additional time for struggling homeowners is important to relieve them of some stress during this challenging period.”

Clavin and Driscoll issued today’s announcement with Senior Councilwoman Dorothy Goosby, Councilman Bruce Blakeman, Councilman Anthony D’Esposito, Councilman Dennis Dunne, Sr., Councilman Tom Muscarella, Councilman Chris Carini and Town Clerk Kate Murray.

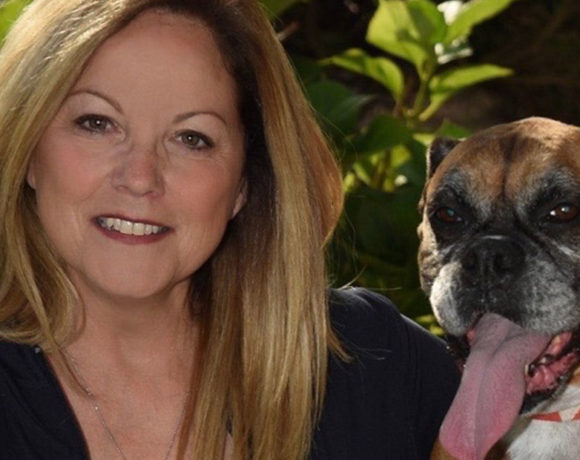

“My office receives hundreds of calls regularly from taxpayers who continue to struggle during the pandemic, whether facing financial distress, job losses or health concerns,” Driscoll said. “Until the pandemic is brought under control, our taxpayers can use all the help they can get. We’re thankful that the Governor has answered our call, and I know that our taxpayers are appreciative of the relief during this trying period.”

The Governor’s executive order, released today, authorizes taxpayers to submit their first half general tax payment by March 12, 2021, without penalty. General tax payments received or postmarked by the U.S. Post Office by March 12, 2021 will be penalty-free. If you pay your taxes through your mortgage company, you do not need to take any action.

In their January 4th letter to the Governor, the Supervisor and Receiver pointed to the quick turnaround of the state’s most recent extension of the first-half school property tax bill deadline, from November 10, 2020 to December 10, 2020. In that period, the school tax bills were affected by the County Assessor’s late and defective tax roll, as well as thousands of admitted errors. In addition, more than 60 percent of county taxpayers were reported to be hit with increases to their 2020-2021 school tax bills as a result of the County Executive’s reassessment.

“Taxpayers have just finished paying the extended first-half school tax bill, and have contended with the shock of seeing increases as a result of the County Executive’s reassessment,” Clavin said. “Extending the first-half general property tax deadline is certainly the right thing to do, and many homeowners will be grateful for the additional time.”

“Coming off the first-half school tax payment period, which had been extended to December and was marred with errors resulting from the County Assessor’s mistakes, the quick turnaround to the first-half general tax was going to be difficult for many people,” Driscoll explained. “This extension to March is welcomed relief for those who were concerned about the original deadline, which was rapidly approaching.”

The Town of Hempstead’s Receiver of Taxes office, led by Driscoll, will continue to provide its array of convenient tax payment offerings, including extended hours, online payments and safe drive-thru and walk-up options. In addition to the Tax Office’s array of convenient payment options, Receiver Driscoll continues to host a series of taxpayer forums with limited seating and RSVP requirements due to COVID-19 health requirements. Visit https://hempsteadny.gov/taxpayer-forums for more information. The series focuses on providing homeowners with important information and resources on how to challenge their property tax assessments and lower their tax bills.

Recent Comments